Chartis RiskTech100 2026

Chartis RiskTech100® is globally acknowledged as the most comprehensive independent study of the world’s major players in risk and compliance technology.

Chartis RiskTech100

Defining Excellence in Risk Technology

October 21-23, 2025 - 9am EDT / 2pm GMT

About the event

The RiskTech100® virtual event on October 21- 23, 2025, promises to be a landmark gathering for risk technology professionals. Here, we'll discuss the latest innovations and strategies in the field and announce the top 100 global risk technology providers from our RiskTech100 report. The event is set to be a melting pot of ideas and networking opportunities.

For close to two-decades RiskTech100® has been the go-to place for clear, accurate, and independent analysis of the risk technology marketplace and the companies doing great things within it.

The RiskTech100 report provides an exhaustive evaluation of the top global risk technology providers. We focus on their strategic vision, market influence, and innovation in risk management technologies, offering a broad perspective on who is leading and shaping the future of the risk technology sector.

If you are an executive, technologist, or strategist in the risk technology sector, this event is crucial for you. Gain insights into the evolving landscape, meet industry leaders, and understand the future direction of risk technology.

Advisory Board members

Olga Baldwin

Lead of third party risk management

StoneX Group

Olga Baldwin is the Lead of Third Party Risk Management (TPRM) at StoneX Group, a Fortune 100 company. With over 16 years of experience in TPRM, she oversees the development and execution of a comprehensive global Third Party Risk Management program. Before joining StoneX, Olga managed TPRM programs at multiple banks and gained valuable experience in the insurance and airline industries. She has extensive expertise in establishing TPRM and Vendor Risk Management (VRM) programs, system implementations, change management, regulatory examinations, and audits. Olga earned her BA from CUNY's Hunter College and an MBA from CUNY's Zicklin School of Business.

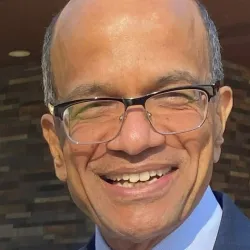

Bala Ayyar

Managing director - Regulatory, Office of the Group COO

Societe Generale

Since joining SG in 2009, he has held a range of positions. Currently, he is the Chief Data Officer, SG Americas, with responsibility for data management and governance within the Region. This function is responsible for implementing the requirements of BCBS 239, establishing sound data governance framework that meets Group needs and local supervisory expectations, and creating a solid platform for the data to be leveraged for strategic business decisions. Prior to that, he headed up the Project Management Office for the SG US Transformation project. SG roles before that included Deputy CFO of the Americas Region of their Corporate & Investment Bank and Head of Finance Offshoring in SG Bangalore.

Prior to joining SG, Bala was with the Canadian Imperial Bank of Commerce (CIBC) for fourteen years in a range of positions in Toronto and New York. As Senior Vice President of the Wholesale North America Finance, he headed up the controllership function for CIBC’s World Markets and Treasury & Risk Management Strategic Business Units within North America. With a global team across Toronto and New York, he was responsible for establishing a SOX-compliant industry-leading Finance control environment as well as supporting the efficient execution of business initiatives and managing the Finance related US regulatory relationships during a very demanding period. Prior to that, he also had stints as the business-line controller for the Bank's US origination businesses (Corporate Lending, Investment Banking, Merchant Banking, Structured Finance, and High Yield), as well as the 2/ic to the Chief Accountant, with responsibility for consolidated financial, management and regulatory reporting at the corporate level.

Born and brought up in Mumbai India, Bala has a degree in mathematics from the University of Mumbai and holds professional accounting qualifications from both India and the United States. He lives in Montclair, New Jersey is married with two children, and enjoys long-distance running.

David Whitehouse

Head of Credit Risk

bunq

Paddy Christie

Senior Manager, Chief Controls Office

Lloyds Banking Group

Paddy Christie is a Governance, Risk and Control subject matter expert and leads Lloyds Banking Group’s Non-Financial Risk Technology strategy. Paddy has 12 years financial services experience leading teams across Business Transformation, Conduct Risk, Operations, and Investment Management. He has a proven track record of delivering complex risk management programmes and recently led the implementation of the company’s operational risk system. Paddy is driven to simplify and modernise non-financial risk by championing the use of data and technology. In his spare time, he enjoys outdoor pursuits and is an accomplished musician.

Minor Huffman

Independent Consultant, former Chief Technology Officer

Instinet

Minor Huffman is a technology leader with extensive executive management experience in capital markets with a focus on electronic trading, risk management, and fund management platforms. Minor has a proven track record designing and developing new software products that increase revenue, improve efficiency and reduce operational risk in the financial services industry.

Most recently, Minor served at the Chief Technology Officer at Instinet, where he was responsible for driving technology innovation, operating the firm's trading platforms, and managing the technology organization globally. Prior to this, Minor served as a Managing Director at Citco Group where he led the development and application support teams for their fund services division.

He was previous Global Head of Rates Technology at Credit Suisse and the Chief Technology Officer at FXall. Minor holds an MBA in Finance and International Business from NYU Stern School of Business and a BS in Computer Science from Massachusetts Institute of Technology (MIT).

Julia Bardmesser

Adjunct Professor

NYU Stern School of Business

Julia is an Adjunct Professor at the NYU Stern School of Business, CEO of Data4Real, LLC, a Board Advisor to several startups and Chair of Technology Advisory Council of Women Leaders in Data and AI (WLDA).

She is a recognized thought leader in data driven digital transformation with over 25 years of experience in building technology and business capabilities that enable business growth, innovation, and agility. Julia has led transformational initiatives in many financial services companies such as Voya Financial, Deutsche Bank Citi, FINRA, Freddie Mac, and others.

Julia is a much sought-after speaker and mentor in the industry, and she has received recognition across the industry for her significant contributions. She has been named to engatica 2023 list of World’s Top 200 Business and Technology Innovators; received 2022 WLDA Changemaker in AI award; has been named to CDO Magazine’s List of Global Data Power Women three years in the row; named Top 150 Business Transformation Leader by Constellation Research in 2019; and recognized as the Best Data Management Practitioner by A-Team Data Management Insight in 2017.

She holds a Master of Arts in Economics from New York University.

Cristiano Bonisoli

Head of ALM

BancoBPM

Cristiano Bonisoli is head of ALM team at BANCOBPM. He is responsible for managing IRRBB at the group level. He started his carrer as a foreign exchange dealer and was later appointed head of treasury, risk manager and then head of ALM at Banca Monte Paschi di Siena.

He then moved to Bancopopolare as head of ALM, and was appointed head of ALM of the new BancoBPM group after the merger with BPM. He graduated in Economics in Milan (Università Cattolica) and holds FRM (financial risk manager) and PRM (professional risk manager) certification.

Cristiano is also co-head of the Assiom-Forex ALM commission in Italy and member of the EBF IRRBB working group.

Yehuda Dayan

Head Thematic Data Science

Citi

Eric Hirschhorn

Chief data officer

BNY Mellon

Eric Hirschhorn is the Chief Data Officer (CDO) of BNY Mellon. He is part of the Global Operations and Technology Executive Committee and reports to the firms CIO, Bridget Engle. As CDO, Eric is focused on digital transformation, operational efficiency, artificial intelligence/machine learning, regulation and helping the firm evolve to become data driven by design.

Before joining BNY Mellon, Eric was the Chief Information Officer for Cantor Fitzgerald and BGC Partners. Prior to Cantor, he spent several years in various senior roles on Wall Street, most recently as Managing Director of Global Fixed Income eTrading & Rates Technology at Bank of America Merrill Lynch.

Prior to Bank of America, Eric was at Morgan Stanley serving as CTO of Fixed Income, at Citi where he ran Global FX technology, at Lehman where he was responsible for Global Fixed Income eTrading, and at JPMorgan Chase where he ran International Treasury technology. His professional life has taken him around the world including several years living in London. Eric is an authority on how technology drives transformation in financial markets. He has been involved in various industry working groups.

Eric graduated Cooper Union in 1989. He holds a Bachelor of Engineering degree in Mechanical Engineering and current serves as Vice Chair of the Board Trustees at the Cooper Union. Eric lives in New Jersey with his wife, Hillary, and their two children.

Get last year's rankings reports

Energy50 2024

The Energy50 2024 report evaluates the key issues and vendors in the energy sector, highlighting transformative technological developments and risks amidst the backdrop of the pandemic, energy transition, and geopolitical changes.

STORM 2024

The STORM 2024 rankings report captures key trends in quant and analytics, including GenAI’s impact, the shift in statistical tools with enhanced compute power, and the emergence of new vendors. This year’s research covers four categories—QuantTech50, RetailFinanceAnalytics50, Insurance Analytics50, and the new BuySideRisk50—each featuring 50 leading vendors.

Financial Crime and Compliance50

The inaugural Financial Crime and Compliance50 (FCC50) report from Chartis Research ranks vendors in the growing FinCrime market, projected to exceed $26 billion. The analysis highlights how tech advances, collaboration, and AI are transforming compliance, with financial institutions seeking cost-effective, impactful solutions.

RiskTechAI 50 2024

The inaugural Chartis RiskTech AI 50 report explores AI’s role in financial services, highlighting key developments and emerging innovations. As AI rapidly evolves, blending with traditional analytics, Chartis identifies the leading companies shaping this dynamic landscape.